Get the free arizona form 650a

Show details

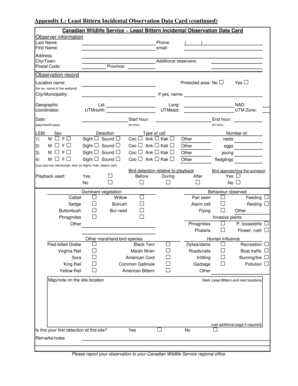

ARIZONA FORM Arizona Department of Revenue Unclaimed Property Section 650A REPORT OF ABANDONED PROPERTY DATE STAMP If you are remitting securities, please use Arizona Form 650B If you are remitting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your arizona form 650a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arizona form 650a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing arizona form 650a online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit arizona form 650 a. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out arizona form 650a

How to fill out Arizona form 650a:

01

The first step is to gather all necessary information and supporting documents, such as personal identification, tax records, and financial statements.

02

Carefully read the instructions provided with the form to understand the requirements and ensure accurate completion.

03

Start by entering your personal information in the designated fields, including your full name, address, social security number, and contact details.

04

Next, provide details regarding your income, including wages, salaries, tips, and any other taxable earnings. Attach any relevant forms or schedules as instructed.

05

Proceed to report your deductions, such as expenses related to business, education, mortgage interest, medical costs, and charitable contributions. Ensure that you have adequate documentation to support these deductions.

06

Calculate your tax liability by using the provided worksheets and tables. Pay close attention to any special calculations or exceptions that may apply.

07

If you have a refund due, provide your bank details for direct deposit or request a check to be mailed to you.

08

Review the completed form for accuracy and legibility before signing and dating it.

Who needs Arizona form 650a:

01

Arizona form 650a is required by individuals who are residents of Arizona and have taxable income for the tax year in question.

02

It is also necessary for those who have earned income from Arizona sources, even if they are not residents of the state.

03

Individuals who wish to claim deductions, credits, or other tax benefits specific to Arizona may also need to fill out this form.

Please note that it is always advisable to consult with a tax professional or the Arizona Department of Revenue for specific guidance and to ensure compliance with the latest tax regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file arizona form 650a?

Arizona Form 650A is the Arizona Withholding Reconciliation Return form. This form is required to be filed by employers who have withheld Arizona state income tax from their employees' paychecks.

How to fill out arizona form 650a?

Form 650a is used to file an Arizona individual income tax return. Here is a step-by-step guide on how to fill it out:

1. Begin by entering your personal information at the top of the form, including your name, Social Security number, and filing status (Single, Married Filing Jointly, Married Filing Separately, etc.).

2. Next, report your total federal adjusted gross income (AGI) on line 1. This information can typically be found on line 11 of your federal income tax return.

3. Proceed to Line 2 to report any Arizona add-backs. These are adjustments you need to make to your federal AGI based on certain state-specific deductions. Follow the instructions on the form to determine if any add-backs apply to you and enter the appropriate amount.

4. On Line 3, you will subtract any add-backs from your federal AGI to get your Arizona taxable income.

5. Line 4 requires you to calculate your Arizona tax liability based on the taxable income reported on Line 3. Refer to the tax tables provided in the instructions to determine your tax.

6. If you made any estimated tax payments throughout the year, report the total amount on Line 5.

7. Line 6 is for any Arizona withholding tax that was withheld from your income by your employer. Enter the total amount withheld.

8. Subtract Lines 5 and 6 from Line 4 to get your total payments and credits on Line 7.

9. If you have any other tax credits or adjustments that you qualify for, report them on Line 8. Provide any necessary documentation to support these credits or adjustments.

10. Calculate the difference between Line 7 and Line 8 to determine whether you owe any additional tax or are entitled to a refund. Enter the amount on Line 9.

11. If you have an overpayment (refund), indicate whether you want it applied to your future tax liabilities or refunded to you by checking the appropriate box on Line 10.

12. Finally, sign and date the form at the bottom, and include any necessary attachments or schedules as instructed by the form's guidelines.

Be sure to review your completed form for accuracy before submitting it to the Arizona Department of Revenue. Additionally, it is always recommended to consult with a tax professional or reference the official instructions provided by the Arizona Department of Revenue when filling out tax forms.

What is the purpose of arizona form 650a?

The purpose of Arizona Form 650A is to report the income received from the Rental, Lease, or License of Arizona Real Property. This form is used by individuals or entities who own or lease real property in Arizona and generate income from it. The form helps in calculating the taxable income generated from such property and is filed annually with the Arizona Department of Revenue.

What information must be reported on arizona form 650a?

Form 650A is the Arizona Individual Income Tax Return. The specific information that must be reported on this form includes:

1. Personal Information: This includes your name, address, Social Security number, filing status, and the same information for your spouse (if applicable).

2. Income: This section requires you to report all sources of income, including wages, salaries, tips, self-employment income, rental income, alimony, unemployment compensation, and any other sources of income.

3. Adjustments: Here, you report any adjustments you are eligible for, such as student loan interest deduction, IRA contributions, self-employment tax deduction, etc.

4. Arizona Additions: This section requires you to report any additions to income, which are income items that are taxable on your federal return but not taxable in Arizona. Examples include certain federal bond interest, state tax refunds from a prior year, etc.

5. Arizona Subtractions: This section allows you to subtract any income from your Arizona taxable income. Common subtractions include Social Security benefits, certain military pensions, retirement income, etc.

6. Tax Credits: You report any tax credits you are eligible for, such as the Earned Income Tax Credit, Credit for the Elderly or Disabled, education-related credits, etc.

7. Payments: This section is for reporting any withholdings or estimated tax payments made throughout the year.

8. Nonrefundable and Excess Credit: You calculate the nonrefundable and excess credit amounts here. These amounts will be used to determine your total Arizona tax liability.

9. Tax, Penalties, and Interest: This section calculates your total tax liability, any penalties or interest owed (if applicable), and your total payment due or refund.

This is a general overview, and the form might require additional information depending on your specific circumstances. It is always recommended to carefully read the instructions provided with the form or consult a tax professional for accurate filing.

What is the penalty for the late filing of arizona form 650a?

The penalty for the late filing of Arizona Form 650A depends on the length of the delay. The penalty is calculated as follows:

- For a delay of up to 30 days: A penalty of $25 or 10% of the tax due (whichever is greater).

- For a delay of more than 30 days but less than 6 months: A penalty of $50 or 15% of the tax due (whichever is greater).

- For a delay of 6 months or more: A penalty of $100 or 20% of the tax due (whichever is greater).

Additionally, interest will accrue on any unpaid tax balance at a rate of 1% per month.

It is important to note that these penalties and interest rates are subject to change, and it is recommended to refer to the official Arizona Department of Revenue website or consult a tax professional for the most up-to-date information.

How do I edit arizona form 650a online?

With pdfFiller, the editing process is straightforward. Open your arizona form 650 a in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I sign the arizona form 650a electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your arizona form 650 a and you'll be done in minutes.

How do I edit arizona form 650a on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign arizona form 650 a. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your arizona form 650a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.